You guys—with your thoughtful, witty and relevant comments—have made me thankful I took up blogging. My (considerable) experience with the mainstream media suggests that you meet a much lower class of people there. Let me give you an example.

Once upon a time I wrote a Forbes column drawing an analogy between protectionism (which discriminates on the basis of national origin) and racism (which discriminates, of course, on the basis of race). (Of course the analogy isn’t perfect. For example, racism can be a solitary hobby, whereas protectionism by its nature forces other people to discriminate as well.) There were many responses, of which my favorite was Pat Buchanan’s screed containing both some hilariously misguided economics and a paragraph I’ve had posted on my office door ever since:

Now I do not know what parents pay to send their kids to the University of Rochester. But if the philosophical imbecility of Landsburg is representative of the faculty, it is too much.

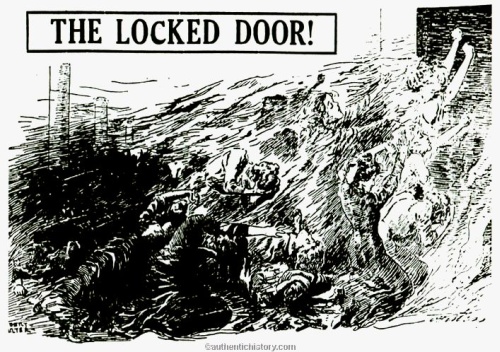

Shortly afterward, I was scheduled to appear on John Gibson’s program on Fox News, where the following exchange took place:

This, in turn, led to a flurry of email. To give you the full flavor, and so as not to bias the sample, I am appending every single email I received on this subject, excepting only one relatively positive note from my mother.