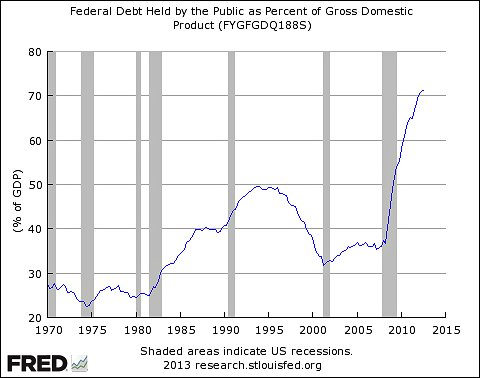

How dire is a government shutdown? Respectable people have made respectable arguments on all sides of that issue. But there’s nothing respectable about the chorus of voices pointing to the pain of furloughed government employees — and pretending this is a reason to end the shutdown, whereas it’s clearly a reason to prolong it.

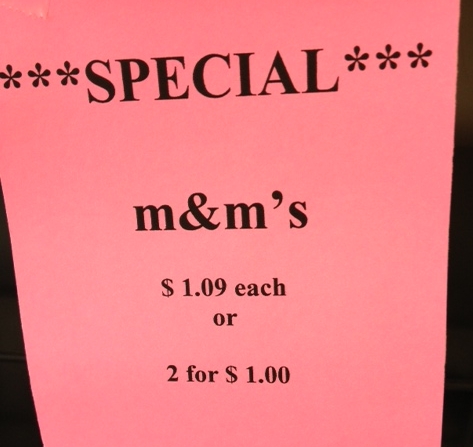

The more painful the furlough, the more overpaid the worker must have been in the first place. People who are paid fair market wages don’t get nearly so upset about losing their jobs — or losing a few weeks of work — as do people who are paid more than their skills reasonably command. Of course there’s always pain associated with an unexpected disruption in your work schedule, even if when your wages are entirely reasonable. But cries of extreme pain amount to admissions that these workers have been ripping the public off for years.

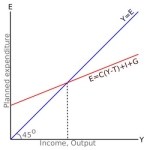

Even without that observation, the pain of interrupted wages cannot by itself be a reason to restart the government, because it is exactly offset by the relief of those who pay those wages.

To make an honest argument in favor of a government operation, you’ve somehow got to point to the social benefits of that operation. In some cases that might be easy. In other cases, it’s hard but possible. But those who shirk the task completely, by focusing not on lost productivity but on lost wages, are just making themselves ludicrous.