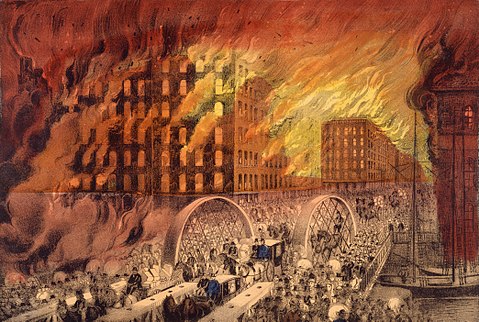

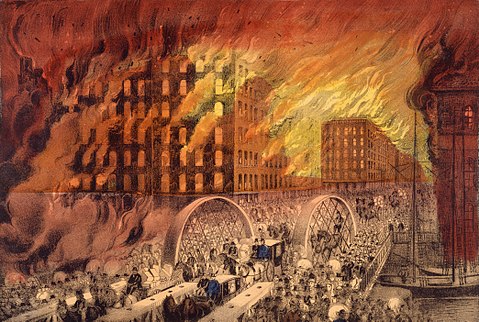

From Frank Harris‘s first-person account of the Great Chicago Fire:

From Frank Harris‘s first-person account of the Great Chicago Fire:

Should oxycontin be legal? Here’s what the back of my envelope says:

In the U.S., there are about 50 million prescriptions a year for oxycontin, most of them legitimate and for the purpose of alleviating severe pain. I’m going to take a stab in the dark and guess that the average prescription is for a two-week supply.

In the U.S., there are about 50 million prescriptions a year for oxycontin, most of them legitimate and for the purpose of alleviating severe pain. I’m going to take a stab in the dark and guess that the average prescription is for a two-week supply.

There are also (at least if you believe what’s on the Internet) about 20,000 deaths a year in the U.S. related to oxycontin abuse. If we value a life at $10,000,000 (which is a standard estimate based on observed willingness-to-pay for life-preserving safety measures), that’s a cost of 200 billion dollars a year, or $4000 per prescription.

If those were all the costs and benefits, the conclusion would be that oxycontin should be legal if (and only if) the average American is willing to pay $4000 to avoid two weeks of severe pain. I’m guessing that might be true in some cases (particularly when the pain is excruciating) but not on average. So by that (incomplete) reckoning, oxycontin should either be off the market entirely or regulated in some entirely new way that will dramatically reduce those overdose deaths.

But of course what this overlooks on the benefit side is all the “abusers” whose lives have been enriched by oxycontin. This includes the vast majority who use and live to tell the tale, and also some of the OD’ers, for whom a few years of oxycontin highs might well have been preferable to a longer lifetime with no highs at all. Relatedly, what this overlooks on the cost side is that the average “abuser” is likely to value his life at considerably less than the typical $10 million — as evidenced by the fact that he’s electing to take these risks in the first place. Also relatedly, it overlooks the likelihood that many of those who overdose on oxycontin would, in its absence, be killing themselves some other way.

If the back of your envelope is larger than mine and you make those corrections, I’m reasonably confident that your bottom line will come out pro-oxycontin. (Please share that bottom line!) I am however, mildly surprised (and — both as a blogger who prefers slam-dunk arguments and as a libertarian who prefers to come down on the side of freedom — mildly disappointed) that the first quick-and-dirty calculation comes out the other way.

There are two kinds of people in this world: The first kind wonders why people stand still on escalators but not on stairs. The second kind wonders what’s wrong with the first kind. After all, if you stand still on the stairs you never get anywhere.

But people of the first kind are not usually dumb. I could give you a long list of top-rate economists and mathematicians who have been stumped by this puzzle. But I could also give you a long list of equally smart people who have been stumped by why anybody thinks it’s a puzzle in the first place. It’s come up again several times recently, because I included it in Can You Outsmart an Economist? and because I talked about it on my podcast with Bob Murphy, which generated a small flurry of email from listeners. So let me try once again to explain what’s going on here.

Let’s divide this into two parts: First, what’s the right way to think about this problem? Second, why is it a problem in the first place?

A commenter in another thread wanted to talk about trolls, so I’m opening up a new post where they’ll be on topic.

A commenter in another thread wanted to talk about trolls, so I’m opening up a new post where they’ll be on topic.

The specific trolls I have in mind operate toll-booths (or troll-booths?), both of which you must pass through to get from Hereville to Thereville. The question is whether you, as a traveler, prefer to have both booths controlled by a single troll, or by separate trolls. (This is Problem 12 in Chapter 3 of Can You Outsmart an Economist?.)

(SPOILER WARNING!)

(Note from the proprietor—I am delighted to present this guest post from my correspondent William Carrington, who might or might not have been inspired by the puzzles in Chapter Nine of Can You Outsmart an Economist?. — SL)

Like zombies and Russian spies, there are more economists among us than you might think. This can be dangerous because studies show that economists are more likely than normal people to graze their goats too long on the town commons, to rat out their co-conspirators in jailhouse interrogations, and to show up drunk on their last day at a job. This appears to be both because unethical people are drawn to economics and because economics itself teaches people to be both untrusting and untrustworthy. This feedback loop has led to the creation of famously difficult economists like John Stuart Mill and….well, it’s a long list. Like halitosis and comb-overs, the problem is worse in Washington.

Can you protect yourself against this unseen risk? Sadly, no, as economists often look all too normal and are hard to pick out from the maladjusted crowds that attend us. This is known as the identification problem in economics, and Norway’s Trygve Haavelmo was awarded a Nobel Prize for his work on this issue. Related work by Ken Arrow, also a Nobelist, proved that an infinitesimal group of economists will bollix up the welfare of an arbitrarily large population of otherwise normal people. It’s most disheartening, but I’m here to offer you a failsafe method for identifying economists. You’ll need an old refrigerator.

In honor of the forthcoming visit of Glen Weyl to the University of Rochester, I thought I’d offer a post explaining the idea behind one of Glen’s signature policy reforms: quadratic voting.

Suppose we’re going to hold a referendum on, say, whether to build a street light in our neighborhood.

The problem with giving everybody one vote is that (on both sides of the issue) some people care a lot more about that street light than others do. We’d like those who care more to get more votes.

In fact, we’d like to allocate votes proportional to each voter’s willingness to pay to influence the outcome. There are excellent reasons to think that willingness-to-pay is the right measure of “caring”. Those reasons will be evident to readers with some knowledge of welfare economics and opaque to others, but it would take us to far afield for me to get into them here. (For the record, if you’re encountering this measure for the first time, you’re almost surely raising “obvious” objections to which there are non-obvious but excellent rejoinders.) For this discussion, I’m going to take it as given that this is the right way to allocate votes.

Here’s the problem: If I allocate votes based on willingness to pay, people will simply lie. If you’re willing to pay up to $1 to prevent the street light, but know that you can get more votes by exaggerating your passion, that’s what you’ll probably do.

Okay, then. If we want to allocate votes based on willingness to pay, then we have to make people actually put some money on the table and buy their votes, thereby proving that they care. We could, for example, sell votes for $1 each. That way, people who care more will buy more votes and have more influence, as they should.

Unfortunately, that’s not good enough. If you care more about the issue than I do, you might buy more votes than I do — but there’s no reason to think you’ll buy more votes in direct proportion to your willingness to pay. Let’s suppose, for example, that the ability to cast a vote is worth $2 to you and $4 to me. Then I should get twice as many votes as you. But if votes sell for $3, I might buy quite a few, whereas you’ll buy none at all. That’s a lot more than twice as many.

So let’s try again: Instead of selling votes for a fixed dollar amount, we sell them on an increasing scale. You can buy one vote for a dollar, or two votes for four dollars, or three votes for nine dollars — and we’ll even let you buy in tiny fractions, like 1/10 of a vote for a penny. The price you pay is the square of the number of votes you buy. That’s the definition of quadratic voting.

Why the square, as opposed to the cube or the square root or the exponential? There really is something special about the square. To appreciate it, try an example: If a vote is worth, say, $8 to you, you’ll keep buying additional votes as long as you can get them for less than $8 each, and then stop. With quadratic voting, one vote costs you a dollar. You’ll take it! A second vote costs you an extra $3 (bringing the total to $4). You’ll take that too! A third vote costs you an extra $5, a fourth costs you an extra $7, and a fifth costs you an extra $9. So you’ll buy 4 votes and then stop. You can similarly check that if a vote is worth $24 to your cousin Jeter, Jeter will buy twelve votes and then stop. Jeter cares three times as much as you do, and he buys three times as many votes. And with a little calculus, you can check that if Aunt Murgatroyd’s vote is worth four or five or nine or twenty times more to her than your vote is to you, she’ll buy exactly four or five or nine or twenty times as many votes as you do. That’s exactly what we wanted. In that sense, this voting scheme works — and, except for minor variations, it’s the only scheme that works.

My new book is now on sale! Readers of this blog will recognize some but not nearly all of these 100+ puzzles (146, actually, by my count). If you’ve enjoyed my puzzle posts, you’ll probably enjoy these extended discussions of some past puzzles, and the many more that are entirely new. Most of these puzzles are designed to teach important lessons about economics, broadly defined to encompass all purposeful human behavior. All of them are also designed to be fun.

Once you’ve had a look, please don’t hesitate to share your opinions right here on the blog — or better yet (especially if your opinions are positive!) don’t hesitate to share them on Amazon or on Goodreads.

Or, if you’d prefer to taste the milk before you buy the cow, here is the introduction, absolutely free of charge.

You can read a few advance reviews here. And remember, the more copies you buy, the sooner I’ll write the sequel.

You’re a policymaker in a country where people buy widgets that are produced both at home and abroad. You can set (separate) excise tax rates on domestic production and imports. (The tax on imports is, of course, what we usually call a tariff.) What tax rates should you set?

The Economics 101 answer makes two assumptions:

1. You care only about the economic welfare of your citizens (and not at all about foreigners).

2. You can’t affect foreign prices (i.e. your country is a negligible portion of the world market for widgets). The fancy way to say this is that the supply of imports is perfectly elastic.

From these assumptions, it follows that both tax rates should be zero. In fact, we can relax assumption 1) and allow you to care as much as you want about the welfare of foreigners; the conclusion doesn’t change.

But suppose we relax these assumptions in a different way:

1A. You care about both the economic welfare of your citizens and (separately) about the tax revenue earned by your government. (I continue to assume, however, that you don’t care about foreigners.)

2A. The foreign supply curve might not be perfectly elastic. Contrary to the Economics 101 assumption, this gives you some market power that you might want to exploit. (I continue to assume, though, that you take the foreign supply curve as given. In particular, this means that your policies do not affect foreign tax rates, so I am assuming away things like retaliatory tariffs.)

Now what’s your best policy? I can’t answer that because you have two competing goals (economic welfare and tax revenue) and I don’t know how much weight you put on one versus the other. But surely if I can show you that Policy A delivers on both goals better than Policy B, you’ll want to reject Policy B. The existence of Policy A leads me to call Policy B inefficient, and surely you’ll want to reject any inefficient policy.

So which pairs of tax rates are efficient?

I learn from Scott Sumner’s blog that in many California cities, residents with past marijuana convictions will jump to the head of the line for licenses to sell the drug legally — this by way of compensating them for past persecution.

Scott approves. I don’t, for two reasons:

First, if you want to compensate people for past persecution, the right way to do it is with cash, not by misallocating productive resources. If there must be licenses, they should be allocated to those who can use them most efficiently, regardless of any past history.

Second, drug dealers have never been the primary victims of anti-drug laws. They can’t be, because there is free entry and exit from that industry. Anti-drug enforcement leads to exit, which in turn leads to higher profits for those who remain — and the exit continues until the profits are high enough to compensate for the risks. One way to think about this: All those “persecuted” drug dealers were, in effect, employing the government to stifle their competition, and paying a fair price for that privilege in the form of occasionally being convicted and punished themselves.

The primary victims of anti-drug legislation are potential consumers who were deterred by artificially high prices. How do you compensate those victims? You can’t. In a population of 1000 people who have never used drugs, it’s quite impossible to identify the 200 or 300 or 400 who would have happily indulged if only the price had been lower.

It was both an honor and a pleasure to deliver the annual Hayek Lecture at the Institute for Economic Affairs last week. Here’s the video:

Like most bloggers, I assign each of my posts to one or more Categories, which are listed in small print somewhere near the top of the post. Among the categories I use are “Economics”, “Politics”, “Policy”, “Math”, “Logic”, “Cool Stuff”, “History”, “Oddities” and “WTF?”. The last of these is perfect for this post, which is written to call your attention to Peter Leeson‘s rollicking new book WTF?!: An Economic Tour of the Weird.

(Edited to add: I see now that the jacket copy on Leeson’s book describes it as “rollicking”. Apparently I’m not the only one who thought this was the right adjective here.)

Leeson, some of whose work I’ve blogged about here in the past, takes us on a tour of some of the world’s seemingly most inexplicable behavior — both historical and contemporary — and uses economic insight to render that behavior explicable after all. His explanations are generally plausible and provocative, though I’m sure many an insightful reader will find plenty to argue with. That, after all, is part of the fun.

Here are the blurbs from the back of the book:

|

|

In my dream, Greg Mankiw and Larry Summers are advising a friend about weight loss.

Mankiw says: If you eat fewer calories, you’ll lose weight.

Summers replies: Not so fast! Sometimes if you eat less ice cream, you crave more cake. Then your calorie intake won’t change and you won’t lose weight. Greg’s advice is fine as an academic theory, but I doubt it will work in practice.

(Note here that Greg never mentioned ice cream in the first place.)

Of course Greg is 100% right, both in theory and in practice. If you eat fewer calories, you will lose weight. Summers responds that if you don’t eat fewer calories, you might not lose weight. True, but entirely off the mark.

I mention this because Mankiw had a recent blog post where he argued that if you cut taxes on capital income you’ll see a big rise in wages. (I happen to have blogged about this twice already in the past 24 hours, but those posts are irrelevant here.) Summers has replied that Mankiw is right in theory but likely to be wrong in practice, and lists three reasons. The first of those reasons comes down to saying that if you cut the corporate income tax, corporations are likely to end up paying more in other taxes, so you haven’t really cut the capital tax after all.

(Note here that Greg never mentioned corporate taxes in the first place.)

Okay, fine. So if you haven’t cut the capital tax, then Greg’s observation doesn’t apply. Likewise, if you haven’t really cut calories, you shouldn’t expect any weight loss. That’s not remotely a refutation.

Continue reading ‘Weight Loss Advice From Big Name Economists’

Earlier today, I blogged about Greg Mankiw’s calculation on the effects of capital tax cuts.

Following a tax cut, Mankiw computes the ratio of the long-run increase in wage payments to the short-run shortfall in government revenues, and, with reasonable assumptions, shows that this ratio has an astonishingly high value of 3/2.

I know how to make that ratio even higher.

The Mankiw Plan is: Cut capital taxes today and watch wages rise tomorrow. The Landsburg Plan is: Cut capital taxes tomorrow and watch wages rise the next day.

Under the Landsburg Plan, the short-run government revenue shortfall (today) is zero, while the long run increase in wages is positive. That gives me a ratio of infinity, which beats Mankiw’s 3/2 ratio by a factor of … infinity.

This is not meant to cast doubt on Mankiw’s result (which is entirely responsive and relevant to the current public debate he was addressing); it is meant to cast light on what’s driving it. When you cut taxes, government revenue falls by more in the long run than in the short run. The long run fall in revenue is what’s driving the wage growth (as I showed in my earlier post), and what drives the result is that the long run fall in revenue is greater than the short run fall. If you can drive down the short-run fall, you can drive up the ratio.

Greg Mankiw has a provocative post on how wages are affected by a cut in the tax rate on capital income. The short version: The effect is huge. If the government commits to a permanent tax cut that costs it $1 in revenue this year, then in the long run, annual wage payments will rise by $1.50 (and the annual revenue shortfall will be even less than $1).

.

That strikes me as huge. Wages grow by more than government revenue falls — in fact, by a factor of about 1/(1-t), where t is the initial tax rate. Mankiw’s $1.50 comes from plugging in an initial tax rate of 1/3.

Although Mankiw’s calculation is simple, straightforward and convincing, it managed to drive me crazy for a substantial chunk of a day, because I didn’t really understand what was driving it. Now I do. So let me explain.

Matthew Nussbaum of Politico tweets that:

There are 50,000 coal miners in the United States. There are 520,000 fast food cooks. Coal miners seem to loom a lot larger in our politics. Wonder why.

If Mr. Nussbaum had read pages 36 and 37 of The Armchair Economist, he’d know the answer. Coal mines are in pretty much fixed supply; new fast food joints are created all the time. Therefore new coal mining jobs are far harder to create than new fast food jobs.

So if conditions get better for coal miners, that’s good for existing coal miners. By contrast, if conditions get better for fast food cooks, more people will become fast food cooks, driving down the wages of existing fast food cooks and negating the improved conditions.

That makes it worthwhile for coal miners to lobby for better conditions, but not for fast food cooks. What’s relevant is not so much the current population of coal miners, but the ease with which that population can expand.

I haven’t seen any of the details, but it looks like the Republican health care plan suffers from many of the same defects as Obamacare, and is in some ways worse.

Mainly: As far as I am currently aware, the plan pretty much leaves in place the main ongoing problem with health care, which is that most people are grossly overinsured, so that health care choices are too frequently made by insurance companies instead of by (cost-aware) consumers and providers. The solution, in broad terms, is to replace insurance with individual health savings accounts (which, if you’re worried about this sort of thing, can be just as heavily subsidized as insurance is). Plenty of Republicans know this, and have been saying it for a long time. But — at least according to what’s in the early news reports — they seem to have come up with a bill that ignores it.

In fact, the Republican bill makes things worse in at least one way, by lifting the Cadillac tax on employer-provided health care plans, thereby encouraging even more overinsurance.

Presumably this was the compromise among feuding factions that the Republican caucus was able to hammer out. Presumably, too, a little leadership from the one person with veto power could have yielded a much better outcome. Too bad the one person with veto power is a self-obsessed loonybird. I do believe a President Bush or a President Cruz — or even, perhaps, a President Clinton — would have insisted on something far far better.

Between his blog, his New York Times columns and his textbooks, Greg Mankiw has probably contributed more than anyone else alive to the cause of economic literacy. But his most recent column is, I think, a rare miss.

Between his blog, his New York Times columns and his textbooks, Greg Mankiw has probably contributed more than anyone else alive to the cause of economic literacy. But his most recent column is, I think, a rare miss.

The thrust of the column is that the estate tax is a bad idea because it violates the principle of horizontal equity by imposing substantially different tax burdens on substantially similar people:

Consider the story of two couples. Both start family businesses when they are young. They work hard, and their businesses prosper beyond anything they expected. When they reach retirement age, both couples sell their businesses. After paying taxes on the sale, they are each left with a sizable nest egg of, say, $20 million, which they plan to enjoy during their golden years.

Then the stories diverge. One couple, whom I’ll call the Frugals, live modestly. Mr. and Mrs. Frugal don’t scrimp, but they watch their spending. They recognize how lucky they have been, and they want to share their success with their children, grandchildren, nephews and nieces.

The other couple, whom I’ll call the Profligates, have a different view of their wealth. They earned it, and they want to enjoy every penny of it themselves. Mr. and Mrs. Profligate eat at top restaurants, drink rare wines, drive flashy cars and maintain several homes. They spend their time sailing the Caribbean in their opulent yacht and flying their private jet from one luxury resort to the next.

So here’s the question: How should the tax burdens of the two couples compare? Under an income tax, the couples would pay the same, because they earned the same income. Under a consumption tax, Mr. and Mrs. Profligate would pay more because of their lavish living (though the Frugals’ descendants would also pay when they spend their inheritance). But under our current system, which combines an income tax and an estate tax, the Frugal family has the higher tax burden. To me, this does not seem right.

The problem with this argument is that it’s not an argument against the estate tax. It’s an argument against any tax (other than a pure $X-per-person-per-year head tax). Try it:

President Obama, defending the Trans-Pacific Partnership, just said something very like the following (I heard this on the radio and am quoting from memory):

And another thing: You’ve got to compare this to the realistic alternatives. It’s not fair to compare it to some ideal, unachievable arrangement where we get to sell things all over the world and never buy anything.

Oh. I assume, then, that he’ll be defending his jobs program in terms something like this:

And another thing: You’ve got to compare this to the realistic alternatives. It’s not fair to compare it to some ideal, unachievable arrangement where we get to work all day and never get paid.

For that matter, this also works as a defense of Obamacare:

And another thing: You’ve got to compare this to the realistic alternatives. It’s not fair to compare it to some ideal, unachievable arrangement where get to spend all our time in hospitals and never get well.

Following the latest round of drivel from Donald Trump, this might be a good time to review the standard textbook case for free trade. (You’ll also find this spelled out in The Big Questions .)

Following the latest round of drivel from Donald Trump, this might be a good time to review the standard textbook case for free trade. (You’ll also find this spelled out in The Big Questions .)

Suppose American manufacturers sell 1000 widgets a year to American consumers at a price of $9 each. Now, thanks to a new free trade agreement, foreign manufacturers can sell widgets to American consumers at $6 each. Let’s try to account for all the different ways that Americans are affected.

1. American manufacturers have two choices: They can match the foreign price of $6, or they can go do something else. If they match the foreign price, they lose $3 per widget (compared to what they were making before). If instead they go do something else, they lose at most $3 per widget. We know this, because they always have the option of matching the foreign price and therefore won’t choose any option worse than that. Therefore, the loss to American manufacturers is at most $3000. (In fact, under very mild assumptions, which almost always hold, the loss is surely less than $3000, but we won’t need to know that here.)

2. Existing American consumers — the ones who were going to buy those 1000 widgets anyway — pay $6 per widget instead of $9 per widget, and therefore collectively save $3000.

3. Some Americans who were unwilling to buy widgets at $9 will happily buy them at $6, and will be happy with their purchases. This is an additional gain to Americans.

Bottom line: American producers lose at most $3000. Existing American consumers gain $3000. New American consumers gain something too. Therefore the gains to Americans must exceed the losses to Americans.

Are you a corporate employee who wishes that your income were tied more closely to your employer’s profits?

Are you a corporate employee who wishes that your income were tied more closely to your employer’s profits?

I have good news for you: There’s an easy way to make that happen. Take 10% (or 5% or 20%) of your wages, and use them to buy corporate stock.

Are you a corporate employee who *doesn’t* wish that your income were tied more closely to your employer’s profits?

I have good news for you, too. You don’t have to buy additional stock if you don’t want to.

Hilary Clinton, however, wants to change all that. She wants to force you into a profit sharing arrangement that is, for all practical purposes, equivalent to forcibly converting part of your salary into corporate stock. If you were planning to do that anyway, this will make no difference to you. If you weren’t planning to do it anyway — if, for example, you preferred to diversify your risks by investing your wages in some other industry — then, of course, this will make you worse off.

(I trust that none of my regular readers is silly enough to respond that Clinton’s plan is much better than buying stock, because you get the profit-sharing in addition to your existing salary. But for the benefit of the occasional drive-by reader, this is not possible. Market pressures insure that your total compensation is equal to the value of what you produce for the company, and if one facet of that compensation goes up, then another must go down.)

Wasn’t there this idea going around that we could explain business cycles through intertemporal substitution of labor supply? (Without the jargon, this means that people work less in times when they are less productive and more in times when they are more productive, so small shocks to productivity — due to random things like weather — tend to have much bigger effects on output.)

Well, it rained here on Wednesday and Thursday of last week, so my roofers spent most of the day pressed up against the garage door trying to stay dry and waiting for little breaks in the rain so they could get something done. On Saturday and Sunday, the weather was beautiful and they didn’t show up. Now it’s Monday and they’re back to work.

My friend and former colleague (and our occasional commenter), James Kahn, weighs in on Federal Reserve policy in a thoughtful piece over at Fox Business.

Some highlights:

Proponents of the Fed’s ZIRP (zero-interest rate policy) will quickly point out that the low inflation numbers in recent years belie any claim that policy has been too loose. In a sense they are right: Policy has not been as loose as interest rates suggest, because the Fed has been pushing forward on one lever (asset purchases) while pulling back on another (paying interest on bank reserves). With the economy’s mediocre fundamentals (those supply factors mentioned above), banks are happy to hold large reserves of cash, thus blunting the impact of the Fed’s enormous balance sheet increase.

Bernanke’s gloating about the lack of inflation is thus somewhat misplaced. The concern about losing control of inflation (in one direction or the other), has always been (or should have been), on the Fed’s ability to manage the transition back to normalcy, i.e. the unwinding of its balance sheet, the raising of interest rates, and the drawing down of bank reserves. The Fed may be able to manage all this, but so far it is just lots of rhetoric – it brags about the ability to do so while postponing actually doing it.

In other words, thoughtful critics have said all along that there’s an inflation risk associated with the (future) transition back to normal monetary policy. Less thoughtful counter-critics have claimed to refute that observation with the counter-observation that right now, inflation doesn’t seem to be a problem. Like the optimist in free fall, they figure we’re doing alright so far.

Another highlight:

Continue reading ‘Overprotective Parents, Falling Optimists, and Other Dangers’

For an upcoming Festschrift, I was recently asked to write an account of Dee (then Don) McCloskey‘s years as a brilliant teacher at the University of Chicago, her influence on a generation of economists, and my own enormous debts to her. This was a great pleasure to write. A draft is here.

For an upcoming Festschrift, I was recently asked to write an account of Dee (then Don) McCloskey‘s years as a brilliant teacher at the University of Chicago, her influence on a generation of economists, and my own enormous debts to her. This was a great pleasure to write. A draft is here.

Yesterday’s post touched on several related points, and I’m afraid the most important one got buried near the end, so I want to repeat it:

1) In the presence of an effective minimum wage, all benefits of the earned income tax credit are transferred to employers. This is, as they say, a matter of Economics 101. (Edited to add: As Bennett Haselton points out in comments, I should have said “dissipated”, not “transferred to employers”. The point remains that the benefits don’t go to the workers, which, for this discussion, is what matters.)

2) Paul Krugman argues that we should have an effective minimum wage in order to prevent some of the benefits of the earned income tax credit from being transferred to employers.

In this context, it should be remembered that Krugman ordinarily reserves his deepest scorn for those who, according to Krugman, willfully ignore the lessons of Economics 101.

Let’s review the argument for 1), with reference to the graph below. In the presence of, say, a $5-an-hour minimum wage, employers will hire 1000 workers. Because more than 1000 people want to work, employers can extract extra concessions in the form of reduced on-the-job-training, shorter breaks, and harsher working conditions. They can get away with exactly $1-an-hour’s worth of this, because even at an effective wage of $4, there are still 1000 people willing to work.

Edited to add: I am assuming that these concessions are of relatively little value to employers (otherwise they wouldn’t have waited for the EITC to demand them!), so that the quantity of labor demanded does not change.

Now let’s add a $3-an-hour earned income tax credit, which shifts the labor supply curve to the dashed position. Ordinarily, this would lead to a lower equilibrium wage, transferring some of the benefits of the EITC to employers. But in the presence of the $5 minimum, wages can’t drop, and employment remains fixed at 1000, though now even more people want to work, allowing employers to impose even harsher conditions until the effective wage drops to $1 an hour (the wage at which there are still 1000 people willing to work). This process transfers all the benefits of the EITC away from the workers.

The question is often raised: “Why would you ever want to raise the minimum wage when you could raise the earned income tax credit instead?”. In other words, if you’ve got a choice between two ways to increase the effective wage rate, why would you choose the one that reduces employment over the one that increases employment?

Paul Krugman has an answer. He’s argued on numerous occasions that the EITC and the minimum wage are complements, not substitutes — that is, each makes the other more effective. So, according to Krugman, once you’ve raised the EITC, the case for a minimum wage hike becomes stronger, not weaker.

Here’s his argument: When you raise the EITC, more people enter the labor market. The increased supply of labor tends to drive wages down, which transfers some of the benefit from the workers you intended to help to the employers and/or consumers who you presumably care about less. To prevent this perverse consequence, one needs a hike in the minimum wage.

The other day, a colleague (who I’m not naming because I’m not sure whether he’d want to be quoted) pointed out that this argument makes not a shred of sense. Here’s why: Any effective minimum wage (that is, any minimum wage set above the wage rate that would prevail in an unregulated market) suffices to do the job Krugman wants it to do. At best, then, Krugman has made an argument for having some minimum wage, not a case for raising it.

Here’s the picture:

Paul A.M. Dirac was a pioneer of quantum mechanics and quantum field theory. His work pervades all of modern physics. He was, by almost all accounts, one of the top 10 physicists of all time, and by many accounts one of the top 2 physicists of the 20th century. And he’s one of my personal heroes.

Paul A.M. Dirac was a pioneer of quantum mechanics and quantum field theory. His work pervades all of modern physics. He was, by almost all accounts, one of the top 10 physicists of all time, and by many accounts one of the top 2 physicists of the 20th century. And he’s one of my personal heroes.

When Dirac was awarded the Nobel prize in 1933, he was asked to say a few words at the banquet that kicks off the multi-day Nobel celebration — and chose, against tradition, to speak about a subject other than physics. Here is Paul Dirac on the source of all our economic problems:

I should like to suggest to you that the cause of all the economic troubles is that we have an economic system which tries to maintain an equality of value between two things, which it would be better to recognise from the beginning as of unequal value. These two things are the receipt of a certain single payment (say 100 crowns) and the receipt of a regular income (say 3 crowns a year) through all eternity. The course of events is continually showing that the second of these is more highly valued than the first. The shortage of buyers, which the world is suffering from, is readily understood, not as due to people not wishing to obtain possession of goods, but as people being unwilling to part with something which might earn a regular income in exchange for those goods. May I ask you to trace out for yourselves how all the obscurities become clear, if one assumes from the beginning that a regular income is worth incomparably more, in fact infinitely more, in the mathematical sense, than any single payment? In doing so I think you would then get a better insight into the way in which a physical theory is fitted in with the facts than you could get from studying popular books on physics.

True to form, then, Dirac set an agenda that others scurried to follow — the agenda in this case being the exploitation of the Nobel prize as a license to spout economic gibberish. Almost a century later, his program continues to flourish.

Suppose you’ve got 1000 students to assign to two schools, each with 500 slots available. Everyone prefers the Good School to the Bad School. Which of the following is a fair way to decide who goes where?

Method A: Give each student a coin to flip and count on the Law of Large Numbers to insure that just about exactly 500 will flip heads. Those students go to the Good School.

Method B: Randomly assign each student to one of two groups. Then flip a single coin to determine which group goes to the Good School.

Method C: After taking note of the fact that, coincidentally, exactly half the students are white and half are black, flip a single coin to determine which race goes to the Good School.

Method D: Assign all the white students to the Good School.

(There’s also of course Method D-prime, where you assign all the black students to the Good School, but I don’t think we need to consider this one separately.)

I ask this question because economists have been very involved with the design of school-allocation mechanisms, particularly in Boston, and one of the things they worry about is fairness. So it seems important to stop and think about what fairness means in this context.

I just spent a little while trying and failing to construct a homework problem for my honors class. Although it didn’t turn out the way I wanted it to, I thought it might serve as a good illustration of how economists (often) think about income redistribution.

The idea is that different people are born with different talents, and that if it were possible for us all to meet in a shadowy pre-birth world (what the philosopher John Rawls called “behind the veil of ignorance”), we’d want to insure against landing in the shallow end of the gene pool — so we’d probably agree that the lucky ones — those with a lot of talent — would help to take care of the rest.

The further idea is that because we’d presumably all have voluntarily signed on to such an agreement, there’s at least a plausible case for enforcing it. (I’ve argued elsewhere that this plausible case does pretty much nothing to justify the actual sorts of redistribution that are practiced by, say, the United States government — but for present purposes, that’s neither here nor there.)

The big problem is to figure out exactly what terms we’d have all agreed on. Jim Mirrlees won a Nobel Prize for a major attack this problem. But I don’t want to ask my college sophomores to digest a Nobel-worthy body of work, so my goal is to construct a sort of baby version of the Mirrlees approach — which I hope might also interest at least one or two blog readers.

Now if governments were omniscient and omnipotent, the problem would be pretty easy — you’d take a whole lot from the rich and give a whole lot to the poor, and you’d forbid talented people to respond by working less.

In practice, though, governments face a lot of constraints. The one I want to focus on is that our talents and/or incomes might be at least partially invisible to the government. You can’t “take from the rich” if you don’t know who the rich are.

One solution is, instead of taking directly from the rich, to tax things that only rich people buy.

So my idea was to imagine that everyone has a natural talent, and an associated natural income, ranging from 0 to 1. You can spend all your income on corn (in whatever quantity you can afford), or you can spend part of your income to buy a car, for a price of 1/2. Obviously, only people with incomes over 1/2 can even consider buying a car, and even some of them might prefer not to.

Continue reading ‘How (not) to Redistribute Income (Warning: High Wonk Content)’